# Slope Mower Depreciation Rates for 2025: What Business Owners Need to Know

The IRS updates its depreciation guidelines annually, and 2025 brings some noteworthy changes for businesses relying on all-terrain mowing equipment. Whether you're a landscaping contractor or manage large agricultural properties, understanding these updates can se you thousands at tax time.

Why Depreciation Matters More Than You Think

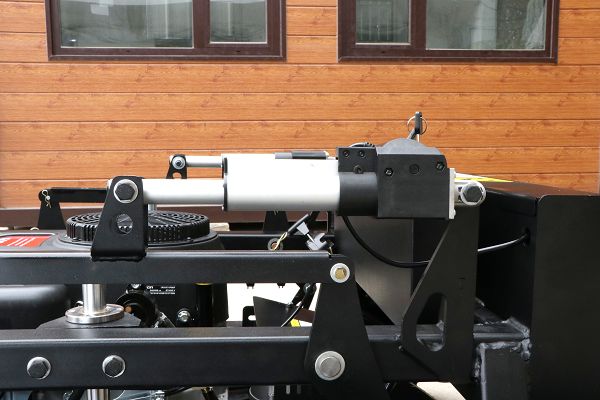

Depreciation isn't just an accounting formality—it's a financial lifeline for businesses that invest in hey-duty machinery. Take Jake, a landscaping business owner in Colorado. Last year, he purchased a commercial remote mower for steep hillsides. Thanks to Section 179 deductions, he recovered nearly 60% of the cost upfront. In 2025, the rules shift slightly, but the sings remain substantial.

Key Changes for 2025

The IRS has adjusted the Modified Accelerated Cost Recovery System (MACRS) tables, impacting how quickly you can write off equipment. Here’s a simplified breakdown:

| Equipment Type | Recovery Period (Years) | 2025 Depreciation Rate |

|---|---|---|

| Slope Mowers (New) | 5 | 20% |

| Used orchard maintenance equipment | 7 | 14.29% |

| Robotic lawn care units | 3 | 33.33% |

Real-World Strategies for Maximizing Deductions

Bundle Purchases: If you're eyeing a new slope mowing solutions system, consider buying before year-end. The "half-year convention" means even a December purchase gets six months of depreciation.

Lease-to-Own Flexibility: Some dealers offer hybrid leases that qualify for depreciation while spreading payments.

The Bottom Line

While tax rules can feel overwhelming, they’re designed to reward investment. Whether you’re maintaining golf courses or vineyards, smart depreciation planning keeps cash flowing. As Jake puts it: "That commercial remote mower paid for itself in deductions before it even needed its first service."

Pro Tip: Always consult a tax professional—especially if you’re mixing equipment types like all-terrain mowing attachments with traditional tractors. The right strategy turns depreciation from a paperwork headache into a profit booster.